Navigating the Impact of Trump's Tariff Deadline

Understanding the Economic Ripples of a 90-Day Tariff Journey

Background of the Tariff Saga

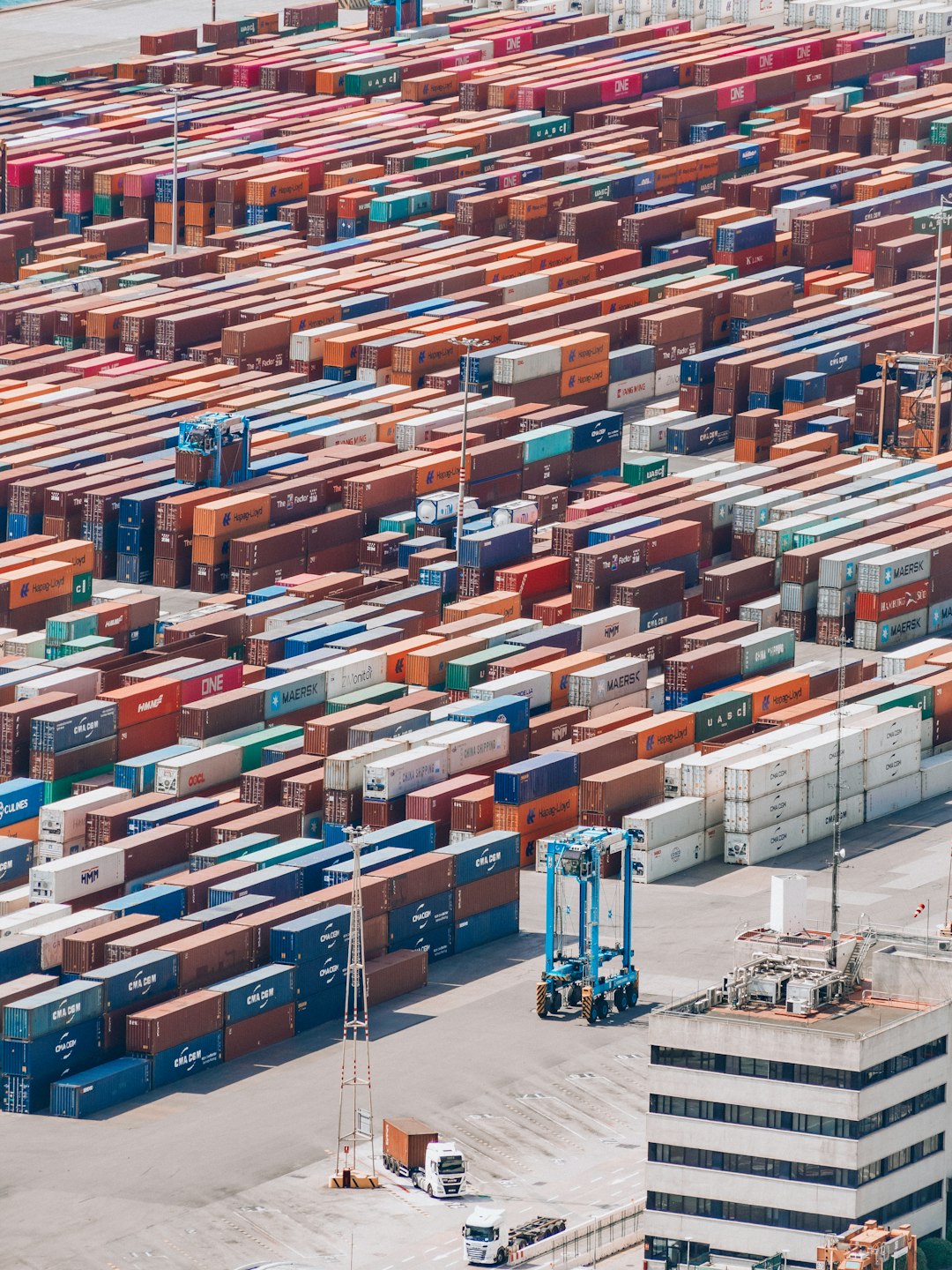

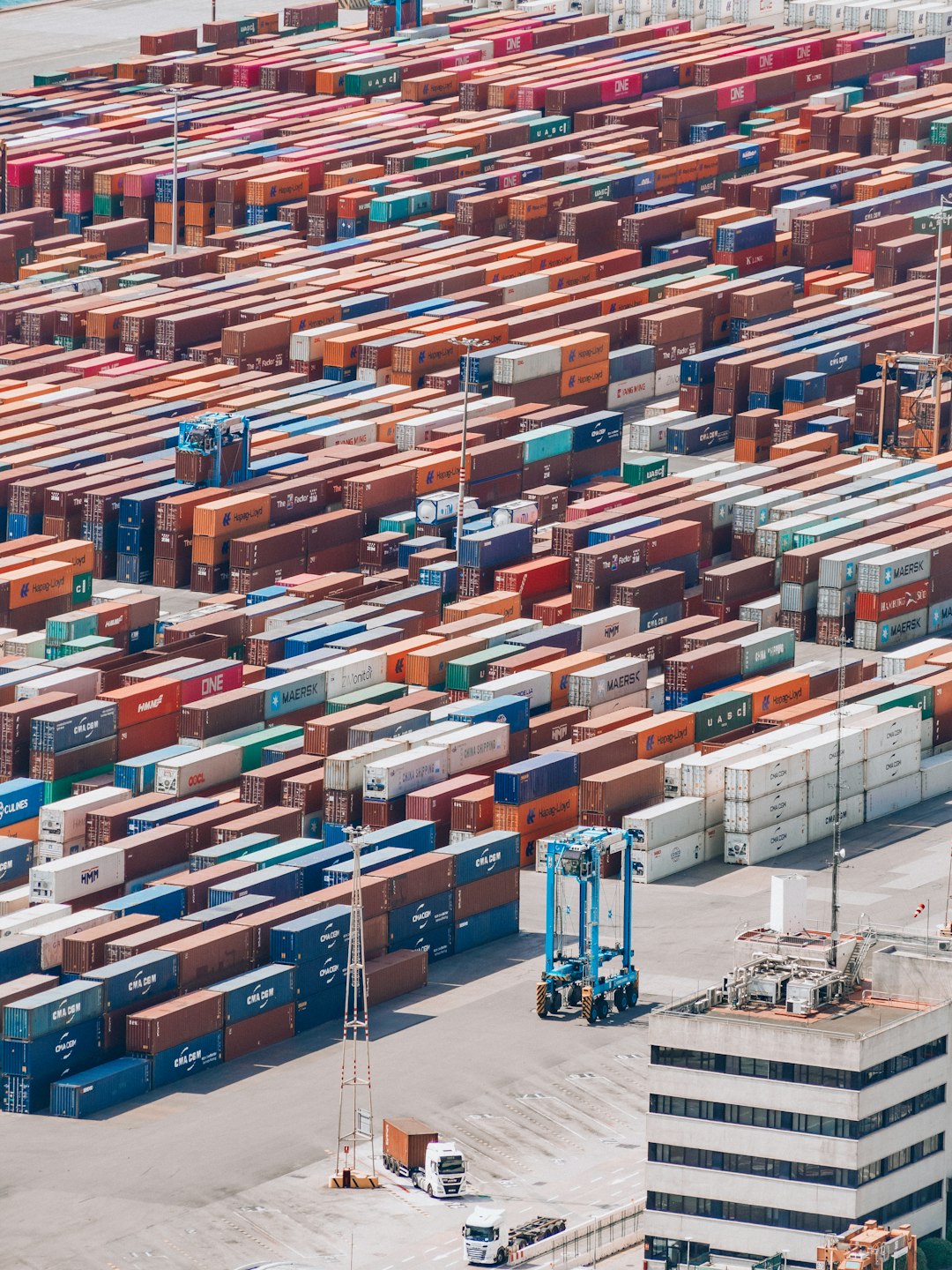

Over the past 90 days, the global markets have been on edge as they anticipated the arrival of President Trump's tariff deadline. The tariffs, aimed primarily at China, are part of a broader trade strategy that has been a cornerstone of Trump's economic policy. The journey leading up to this deadline has been marked by intense negotiations, market uncertainty, and geopolitical tensions.

The Economic Implications

The imposition of tariffs has far-reaching economic implications. For the United States, the tariffs are designed to protect domestic industries from foreign competition. However, they also risk increasing the cost of imported goods, which can lead to higher prices for consumers and potential retaliation from trading partners. The tariffs have also contributed to volatility in the stock market, as investors assess the potential impact on corporate earnings and global trade.

Market Reactions

Market reactions to the tariff deadline have been mixed. Some sectors, such as manufacturing and agriculture, have experienced significant stress due to disruptions in supply chains and export markets. On the other hand, some domestic industries have welcomed the tariffs as a way to level the playing field against foreign competitors. The stock market has experienced fluctuations as traders digest news of negotiations and potential resolutions.

Geopolitical Tensions

The tariffs have not only economic but also geopolitical implications. The trade tensions between the US and China have strained diplomatic relations, with both nations engaging in a tit-for-tat exchange of tariffs. This has raised concerns about a potential trade war, which could have broader implications for global economic stability and international relations.

Future Outlook

Looking ahead, the resolution of the tariff situation remains uncertain. While some analysts are optimistic that a deal could be reached, others warn that prolonged trade tensions could lead to a slowdown in global economic growth. Businesses and investors are closely watching for any developments that could signal a change in the current tariff strategy.